Know Your Client Anti Money Laundering

The idea of money laundering is essential to be understood for those working in the financial sector. It is a process by which dirty cash is transformed into clean cash. The sources of the cash in actual are prison and the cash is invested in a means that makes it appear to be clean cash and hide the identification of the legal part of the money earned.

While executing the financial transactions and establishing relationship with the brand new customers or sustaining current customers the obligation of adopting ample measures lie on each one who is part of the organization. The identification of such aspect in the beginning is simple to take care of as a substitute realizing and encountering such conditions afterward within the transaction stage. The central financial institution in any nation supplies full guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously present enough security to the banks to discourage such situations.

Anti-Money Laundering Policy and Know Your Client Policy. In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to.

Know Your Customer And Anti Money Laundering Measures Ing

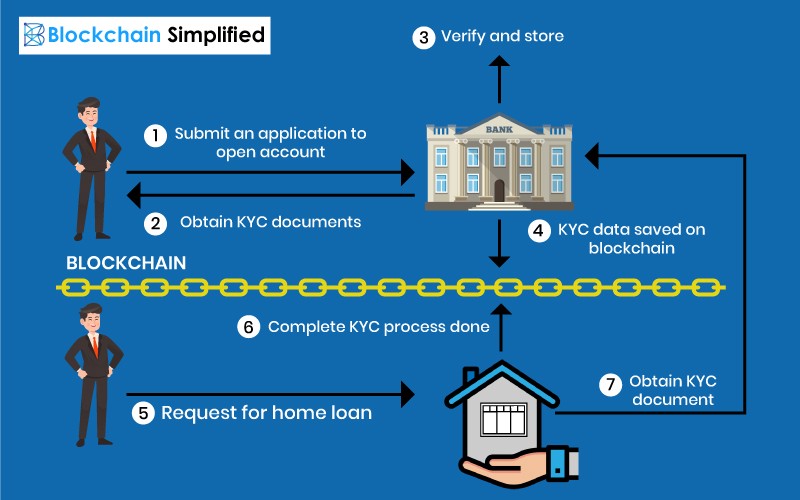

Know Your Customer KYC is an identity verification system used by banks to identify their clients.

Know your client anti money laundering. Page 5 of 5 E-02-2010. 282010 12635 PM. AML procedures are constructed with the objective of managing hazards.

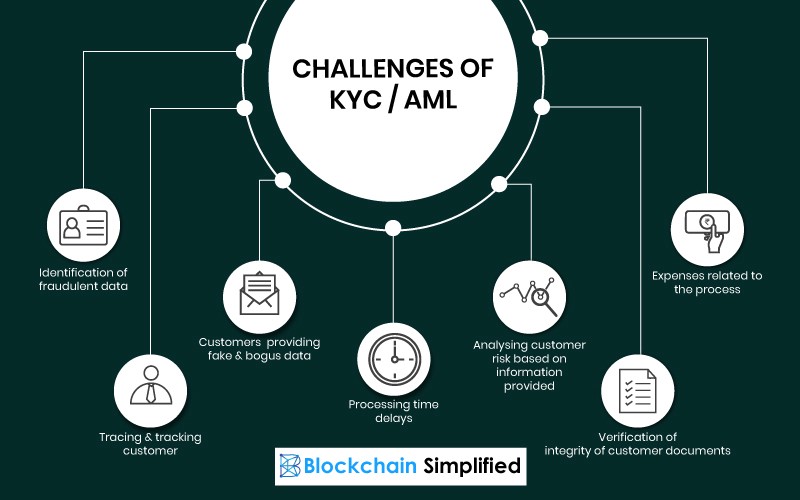

This includes carrying out customer due diligence checks updating customer files screening customers and transactions monitoring transactions and reporting suspicious activities. Know Your Customer KYC is an identity verification system used by banks to spot their clientele. Know your client checks KYC form part of anti money laundering checks regulations AML which govern the activities.

It ensures we only do business with people and companies we have verified as being trustworthy. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. In accordance with international and local regulations Bitzlato implements effective internal procedures and mechanisms to prevent money laundering terrorist financing drug and human trafficking the.

16 December 2020 year. Anti-Money Laundering and Know Your Client Policies RubyFinance holds a zero tolerance fraud policy and is taking all measures possible to prevent it. Country Money Laundering Risk Rankings.

All funds in these accounts will be forfeited. Banks have a responsibility to know their customers and a banks KYC procedures help them do that. AML procedures are built with the goal of managing risk.

Anti-Money Laundering AML meanwhile has a broader scope. Effective KYC involves knowing a customers identity their financial activities and the risk they pose. KYC and AML are acronyms for Know Your Customer and Anti-money Laundering and refer to the set of activities that both financial institutions and regulated businesses must perform to verify the identity of their customers and obtain sensitive information from them as well as prevent money laundering from illegal activities.

This audit checklist is to assist in preparation for the anti money laundering AML process. The anti-money laundering and Know your client policy hereinafter referred to as AML KYC Policy is designed to prevent and reduce the. This Anti-Money Laundering and Know Your Client Policy hereinafter - the Policy is designed to prevent and mitigate the risk of Walleteze OÜ being involved in any kind of illegal activity.

Walleteze OÜ implements effective internal procedures and instruments to prevent illegal transfer of assets drugs humans organs and any other illegal. The case under examination concerned a bank the defendant the officials of which were being summoned to produce the anti-money launderingknow your client. Banks have a responsibility to know their customers and also a banking KYC approaches help them accomplish this.

Ratings Table Information Our risk ranking tool has been designed to provide a measure of the money laundering risk of countries that your organisation might have client relationships with or doing business with. Anti-Money Laundering AML meanwhile includes a wider range. Know your customer KYC is the first step towards a safe and compliant bank.

KnowYourCountry is one of the worlds leading on-line Global Anti-Money Laundering research tools. Oversight and that Anti Money Laundering AML regulatory requirements are being adhered to at both a local and global level. Appendix E - Know Your ClientAnti-Money Laundering Anti-Terrorism DUE DILIGENCE QUESTIONNAIRE.

The anti-money laundering andKnow your client policy hereinafter -AML KYC Policy is designed to prevent and reduce the potential risks of Bitzlato being involved in any illegal activity. Name Address Author. Accurate and reflective of my institutions Know Your CustomerAnti-Money laundering policies.

Any fraudulent activity will be documented and all related accounts to it will be immediately closed. Anti-Money-Laundering and Know-Your-Customer Policy AMLKYC In order to protect the funds of its clients and ensure the compliance with international trade standards Optionfield Limited hereinafter referred to as the Company operates exclusively in accordance with the law on combating money laundering gained by criminal means and countering the financing of terrorism and criminal activities.

Blockchain Use Case For Kyc Know Your Customer Aml Anti Money Laundering Blockchain Simplified

What Is Know Your Customer Kyc Anti Money Laundering Aml Master The Crypto

Blockchain Use Case For Kyc Know Your Customer Aml Anti Money Laundering Blockchain Simplified

Difference Between Kyc And Aml Tookitaki Tookitaki

Buy Anti Money Laundering Know Your Customer Book Online At Low Prices In India Anti Money Laundering Know Your Customer Reviews Ratings Amazon In

Best Explained Know Your Customer Kyc Anti Money Laundering Aml Study Capsule Youtube

Know Your Customer In Fintech Paytah

What Is Kyc Know Your Customer And Aml Anti Money Laundering Mobbeel

Kyc Vs Aml What Is The Difference

Anti Money Laundering And Counter Terrorism Financing

Banking Compliance Software Kyc Aml Suitability And Transfer Software For Private Banking

What Is Know Your Customer Kyc Anti Money Laundering Aml Master The Crypto

Kyc Market Update Latest Know Your Customer Insights

Difference Between Kyc And Aml Tookitaki Tookitaki

The world of rules can seem to be a bowl of alphabet soup at times. US money laundering rules aren't any exception. We've compiled an inventory of the top ten money laundering acronyms and their definitions. TMP Danger is consulting agency targeted on protecting financial providers by reducing risk, fraud and losses. We've got big bank experience in operational and regulatory risk. We have a robust background in program management, regulatory and operational danger as well as Lean Six Sigma and Business Process Outsourcing.

Thus cash laundering brings many adversarial consequences to the organization because of the risks it presents. It increases the probability of major dangers and the chance value of the financial institution and ultimately causes the financial institution to face losses.

Comments

Post a Comment