Anti Money Laundering Gov

The concept of money laundering is essential to be understood for these working within the monetary sector. It's a course of by which soiled money is transformed into clean cash. The sources of the cash in actual are prison and the cash is invested in a means that makes it seem like clean money and hide the identification of the legal part of the cash earned.

Whereas executing the financial transactions and establishing relationship with the brand new clients or sustaining existing prospects the duty of adopting sufficient measures lie on every one who is part of the organization. The identification of such ingredient to start with is easy to cope with as an alternative realizing and encountering such situations in a while in the transaction stage. The central bank in any nation offers full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously provide enough safety to the banks to discourage such conditions.

Dirty money appear legal ie. 26 rows Anti-money laundering registration If you run a business in the financial sector you may.

Anti Money Launder Aml Cft Guide Bi 260218 With Letter Money Laundering Government Information

Establish an effective suspicious activity monitoring and reporting process.

Anti money laundering gov. Establish effective customer due diligence systems and monitoring programs. The United States Department of the Treasury is fully dedicated to combating all aspects of money laundering at home and abroad through the mission of the Office of Terrorism and Financial Intelligence TFI. History of Anti-Money Laundering Laws Money laundering is the process of making illegally-gained proceeds ie.

5 Series of 2021 on the Guidance for De-Listing and Unfreezing Procedures to assist covered persons government entities and the public on the implementation of the targeted financial sanctions TFS. Antimoney laundering and counterterrorism financing program has the meaning given by section 83. HMRC sends messages to your anti-money laundering supervision account not your business tax account.

Youll need to sign in to your account to read them. Message from the FinCEN Director. TFI utilizes the Departments many assets - including a diverse range of legal authorities core financial expertise operational resources.

Placement layering and integration. Financial institutions that the Financial Action Task Force FATF an intergovernmental body that establishes international standards to combat money laundering counter the financing of terrorism and combat weapons of mass destruction proliferation financing AMLCFTCPF has updated its. 1 345 946-0022 E.

AMLCTF Rules short for AntiMoney LaunderingCounterTerrorism Financing Rules means the rules made under section 229. WASHINGTON The Financial Crimes Enforcement Network FinCEN is informing US. Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must.

Typically it involves three steps. Establish effective BSA compliance programs. Screen against Office of Foreign Assets Control OFAC and other government lists.

Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering. Call HMRC if your business is covered by the Money Laundering Regulations and you need advice or information on how to report suspicious transactions. The Anti-Money Laundering Act of 2020.

5th Floor Government Administration Building PO Box 136 133 Elgin Avenue George Town Grand Cayman KY1-9000 CAYMAN ISLANDS. There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering. And also leads the Irish delegation at the Financial Action Task Force FATF on Money Laundering in the development of policies to combat money laundering and terrorist financing at the international level.

These documents are formulated in accordance with the provisions of the Anti-Money Laundering Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 AMLA Read More. CORAL iSEMTM is a state-of-the-art Anti-Money Laundering AML and Anti-Terrorism Financing ATF Solution that enables financial institutions FI to comply with AMLATF regulatory requirements. Said guidance covers the following.

Register or renew your money laundering supervision with HMRC Fees youll pay for money laundering supervision Apply for the fit and proper test and HMRC approval. A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering. The Department of Finance takes a lead role in the forming of national policy regarding negotiations at EU level on the introduction of Anti-Money Laundering legislation.

180-Day Update on AML Act Implementation and Achievements June 30 2021 AMLCFT Priorities AML Act Section 6101 AMLCFT Priorities June 30 2021 Statement for Banks June 30 2021 Statement for Non-Bank Financial Institutions June 30 2021 News Release June 30 2021. Anti-money Laundering and Combating Financing Terrorism Law No. First the illegitimate funds are furtively introduced into.

The Anti Money Laundering Council AMLC released AMLC Regulatory Issuance No. 302016 mentioned the regulators concerned with regulating and supervising the compliance of the institutions with implementation of the provisions of the laws regulations decisions and directives issued to enforce the law.

Republ Feso Future Entreprenuers Student S Organization Facebook

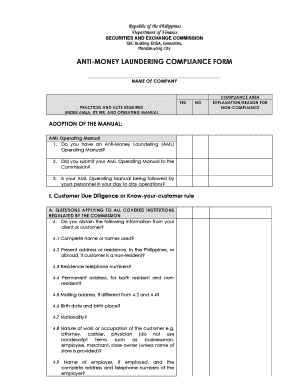

Fillable Online Sec Gov Anti Money Laundering Compliance Form Securities And Exchange Sec Gov Fax Email Print Pdffiller

Anti Money Laundering Policy Pdf

Bank Secrecy Act Anti Money Laundering Examination Manual U S Government Bookstore

The Anti Money Laundering Act Of 2020 Fincen Gov

Revised Central Bank Amla Guidelines Anti Money Laundering

Anti Money Laundering Department Achievement Infographics

Anti Money Laundering Fincen Should Enhance Procedures For Implementing And Evaluating Geographic Targeting Orders U S Gao

The Money Laundering Terrorist Financing And Transfer Of Funds Information On The Payer Regulations 2017 Impact Assessment

Prevention Of Money Laundering Gov Si

The world of laws can seem to be a bowl of alphabet soup at times. US money laundering regulations are not any exception. Now we have compiled a listing of the highest ten cash laundering acronyms and their definitions. TMP Risk is consulting firm focused on defending monetary companies by lowering threat, fraud and losses. We have now huge bank expertise in operational and regulatory risk. We've a robust background in program management, regulatory and operational danger in addition to Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many adversarial consequences to the group as a result of dangers it presents. It increases the probability of major dangers and the opportunity price of the bank and in the end causes the financial institution to face losses.

Comments

Post a Comment